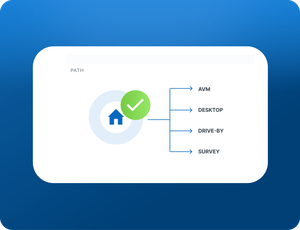

The LOOP module enables lenders to instantly and remotely check the suitability of each property for which a new mortgage application is received. It is effectively a ‘digital D.I.P.’ on the property. Based simply on the address, the mortgage amount and proposed deposit, each property is instantly screened against Lending Rules, LTV Criteria and Title Deed Issues. Typically, 90-95% pass this initial suitability check, with 5-10% being rejected and 'looped' back to the broker/applicant. The LOOP module therefore stops lenders wasting time and money processing mortgage applications and investing in physical surveys and valuations for properties that will be declined at a later stage.

Whenfresh.com has now merged with PriceHubble.com

To provide you with a better experience and improved content, your login page and all our resources are now available on a single website. You will be automatically redirected in a few seconds. If the redirection doesn't happen, please click the button below.

Redirection in 10 seconds...

Go directly to pricehubble.com